- The Thread

- Posts

- Meta's AI comes for housing and financial services ads

Meta's AI comes for housing and financial services ads

Plus: How smart is Google's "smart cropping"?

Today’s Social Media advertising rates are are off and running:

↗️ META: $8.02 | ↘️ TIKTOK: $2.68 CPM | ↘️ SNAPCHAT: $10.32 CPM

In this week’s edition:

🚨 Buyer Beware: Google’s “Smart Cropping” isn’t always

YouTube analytics splits your views in two 📊

👻 Snapchat gets serious about budget optimization

But first…

🧠 Meta’s AI rolls out for Housing, Employment, and Financial Services ads

Meta is rolling out its Advantage+ Audience and related automation tools to campaigns in the so-called “Special Ad Categories”—including Housing, Employment, and Financial Products and Services.

Until now, advertisers in these regulated categories were restricted from using certain targeting features and advanced optimization tools due to anti-discrimination regulations. This meant that Meta’s automated, AI-driven products — like Advantage+ Audience, Advantage Custom Audience, and Advantage Detailed Targeting — were off-limits.

With this latest update, Meta is bringing its top performance tools to these advertisers, allowing them to benefit from the same machine learning optimization that’s driven efficiency gains elsewhere on the platform. Early results from Meta show performance improvements across objectives, including reductions in cost per result for awareness, engagement, and sales campaigns.

👉 It’s important to note that while Advantage+ Audience is now available, core targeting restrictions still apply — advertisers in Special Ad Categories still can’t target by attributes such as age and gender.

The Inside Scoop🍦: Now trending in performance media

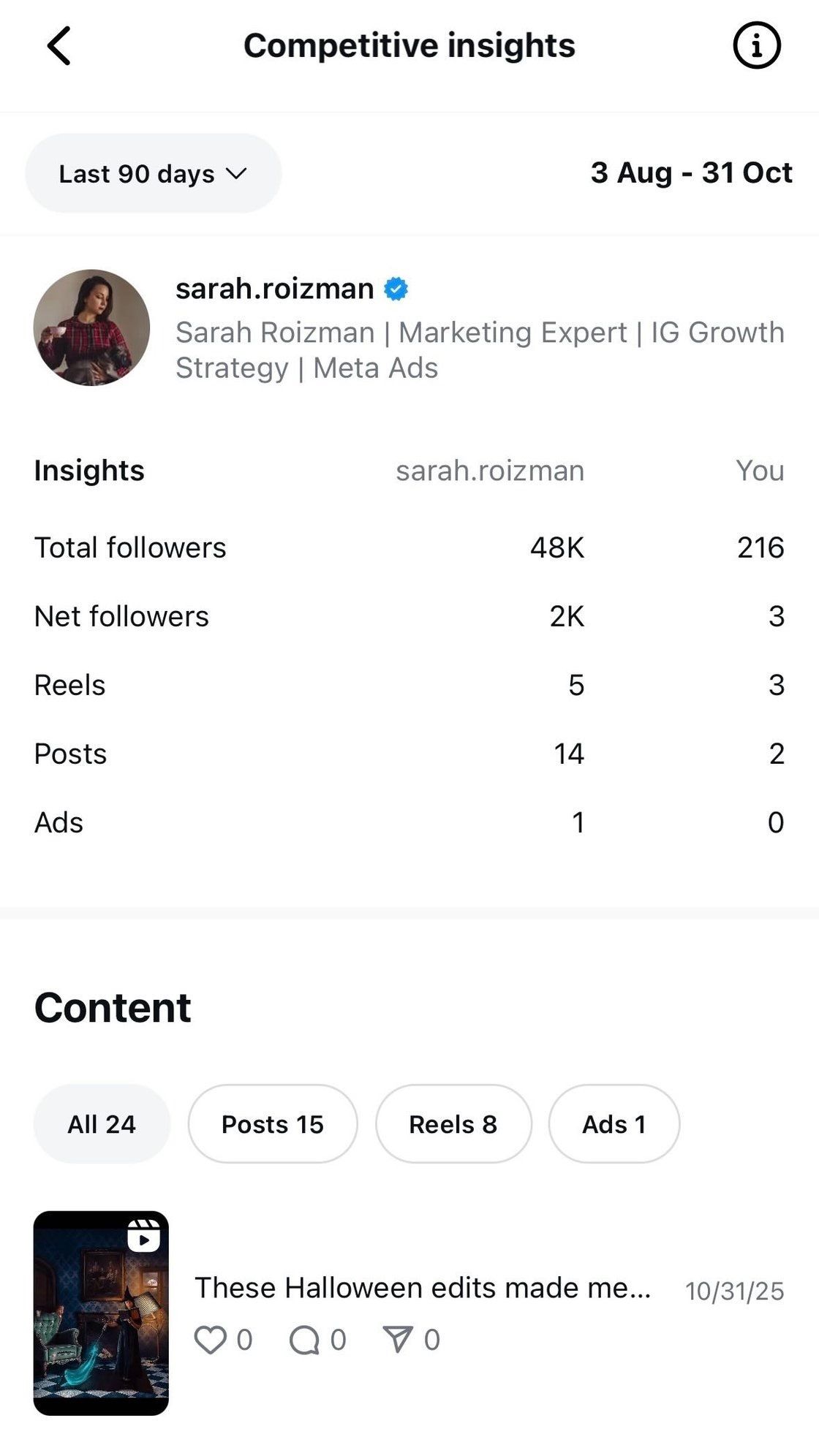

📊 Instagram has added a new Competitive Insights feature that lets business or creator accounts compare their account and post performance with competitor accounts. The feature compares up to ten competitors’ metrics with your own, including follower growth, posting frequency, reels posted, and ads (boosted posts only). You can see like counts, even when your competitor has hidden their like count:

💅 Pro Tip: the Instagram Followers metric will be available in the Meta API in the first half of 2026.

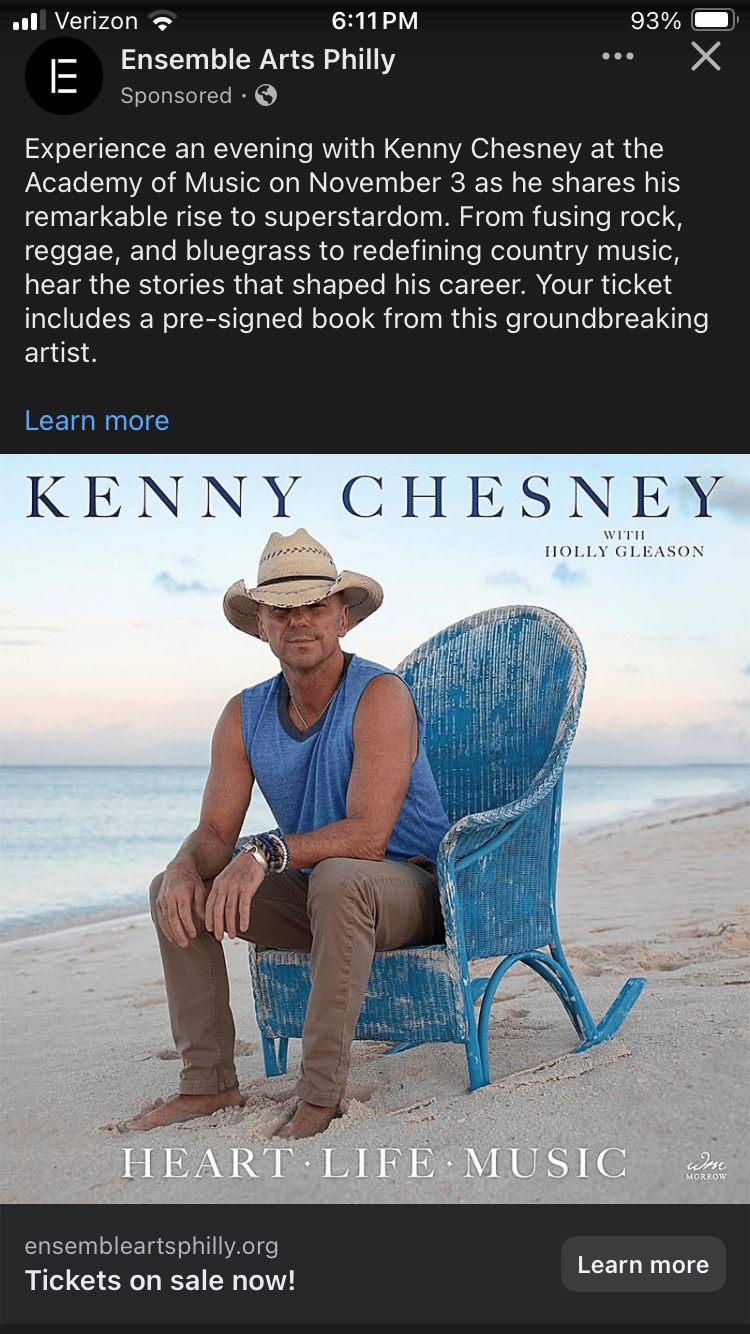

🐆 Spotted in the wild: Meta appears to be experimenting with moving the call to action (CTA) into the ad copy, like so:

🚨 Buyer Beware: Meta is rolling out a new creative enhancement that will automatically transform static carousel ads into auto-scroll videos. The algorithm will serve an auto-scroll version of the carousel whenever it deems the user more likely to engage with this format vs traditional carousel unit rendering. Currently, there is no way to opt-out of serving carousels as auto-scrolls, and there is no way to preview the experience in ads manager.

Because of the nature of auto-scroll, this will result in "video views" as a reported metric.

Auto-scroll carousels will show all carousel cards in the same order as the static carousel, and no music will be added “at this time.”

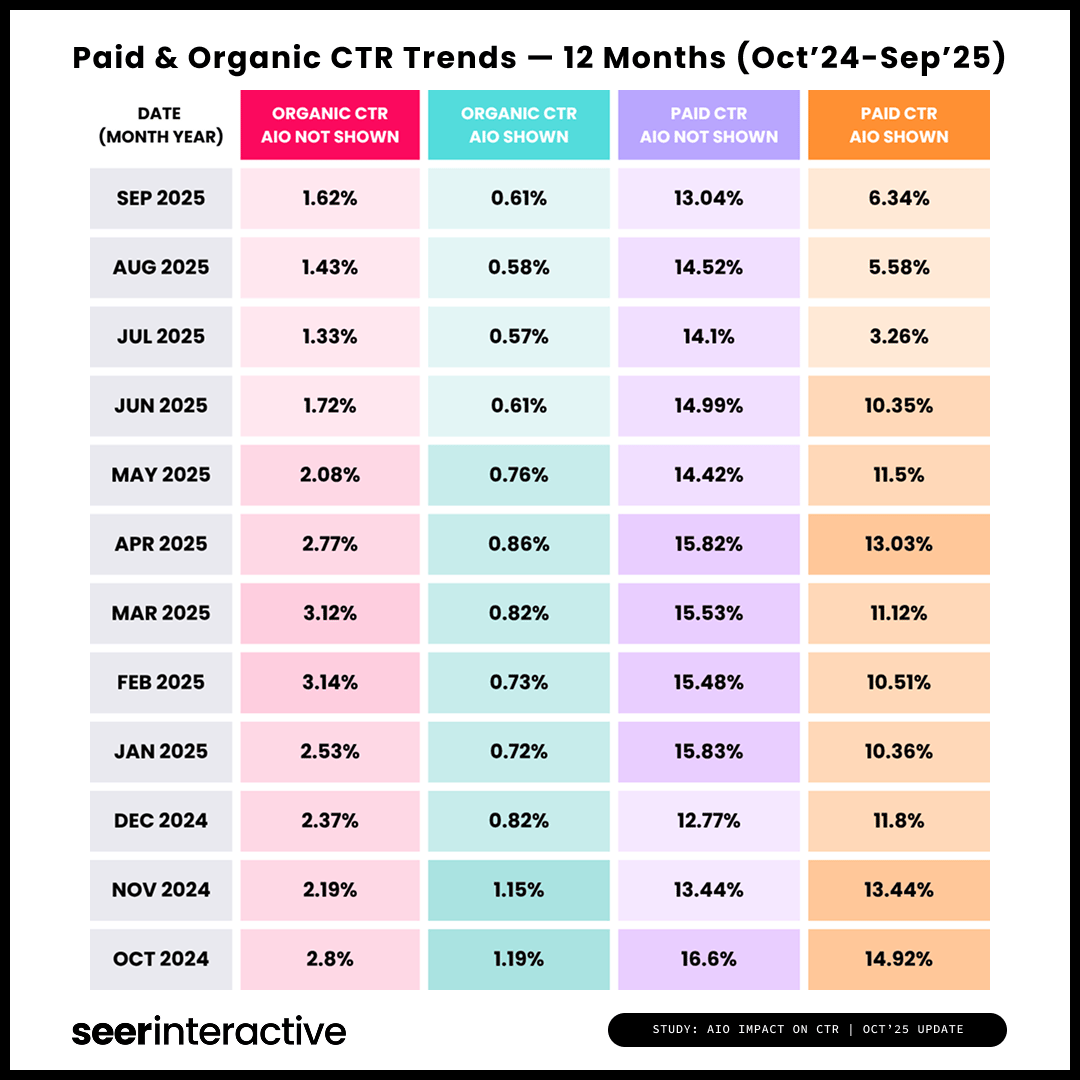

🔎 Google: Even when AI Overviews aren’t visible on Google search results pages, overall clicks and CTR are still declining, likely due to ChatGPT/AI platforms and social search. That’s the headline from a recent study by marketing agency Seer Interactive. According to the study, organic CTR for informational queries featuring Google AI Overviews fell 61% since mid-2024, while paid CTRs on those same queries fell 68%. And even on queries without AI Overviews, organic CTRs fell 41%.

💡 Also worth noting: Brands cited in AI Overviews earned 35% more organic and 91% more paid clicks than those not cited.

🐭 Disney’s channels—including ESPN and ABC—have officially been removed from YouTube TV after Disney and Google failed to resolve a distribution dispute. Disney’s sports programming—including NFL and college football—has been a key player in helping YouTube TV sustain subscription numbers. This loss for sports fans is also a loss for advertisers, who have now lost access to key live sports content.

📺 YouTube is adding paid and organic metric splits to its analytics. This will let YouTube Analytics users see how their organic and paid content performance differs across most metrics, including views, engaged views, likes, comments, shares, and watch time.

🚨 Buyer Beware: Google will automatically create assets in your Performance Max campaigns—for example, if your campaign doesn’t have video assets—unless you contact a Google ads rep to opt out. However, keep in mind that even this opt-out will last for only 90 days, designed as a grace period during which you’re supposed to be creating the missing asset types.

🚨🚨 Some advertisers have also noticed oddly cropped product images in Google Shopping ads. This is due to Smart Cropping (enabled by default), which uses automation to zoom in on what Google determines to be the most relevant part of a product image, resulting in awkward cropping. Annoyingly, advertisers cannot disable Smart Cropping by themselves: you need Google support to turn it off for your account.

👻 Snapchat is finally getting with the times and rolling out their version of campaign budget optimization (CBO), called Smart Budget. Here’s what we know:

Smart Budget is still in beta testing, and available only for Impressions and Pixel Purchase-optimizated campaigns.

Cannot be applied to existing campaigns, only net-new campaigns.

Can work for either auto-bid or max bid strategies.

Only available for Snap Ads and Story Ads, not available for dynamic ads yet.

Advertisers can still set ad set spending limits (similar to Meta) to set a minimum and/or maximum spend at the ad set level.

💅 Pro Tip: Snapchat is now beta-testing value-based optimization. Currently, it’s only available for auto-bid, but tROAS bidding is coming later in Q4.

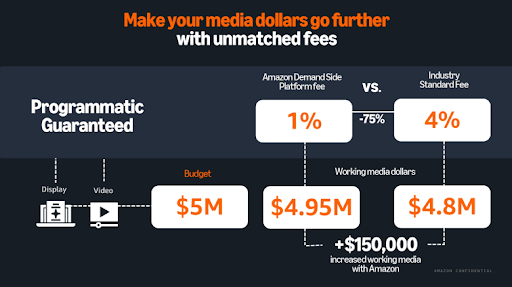

📦 Amazon’s latest pitch deck is making the rounds at agencies — and it’s not just about selling Amazon ads. The company wants its DSP to be the backbone for buying across the open web, positioning itself as a cheaper, data-richer alternative to The Trade Desk. The highlights:

Amazon now claims monthly reach across 86% of the U.S. population, powered by inventory deals with Netflix, Disney, NBCU, Spotify, and Hearst.

With fees as low as 1% on Programmatic Guaranteed deals, Amazon says it’s 4–6% more efficient than TTD

Amazon’s biggest growth engine is connected TV, now supercharged by AI tools that blend advertiser data with its retail and ad-tech signals for smarter attribution and optimization.

📉 By the numbers: Streaming TV is even more ad friendly

For the most part, ad-supported viewing has increased on streaming TV. On Netflix, 45% (nearly half!) of viewing happened on its ad tier in August 2025, up from 34% in August 2024. Viewing on Disney+’s ad tier was up 16 percentage points, while Prime Video and HBO Max both saw ad tier viewership increase by 10 percentage points YoY. However, YouTube saw a drop of 2%.

Thanks for reading! We’ll be back next week to fill your inbox with more tips, tricks, and treats from the addressable universe.